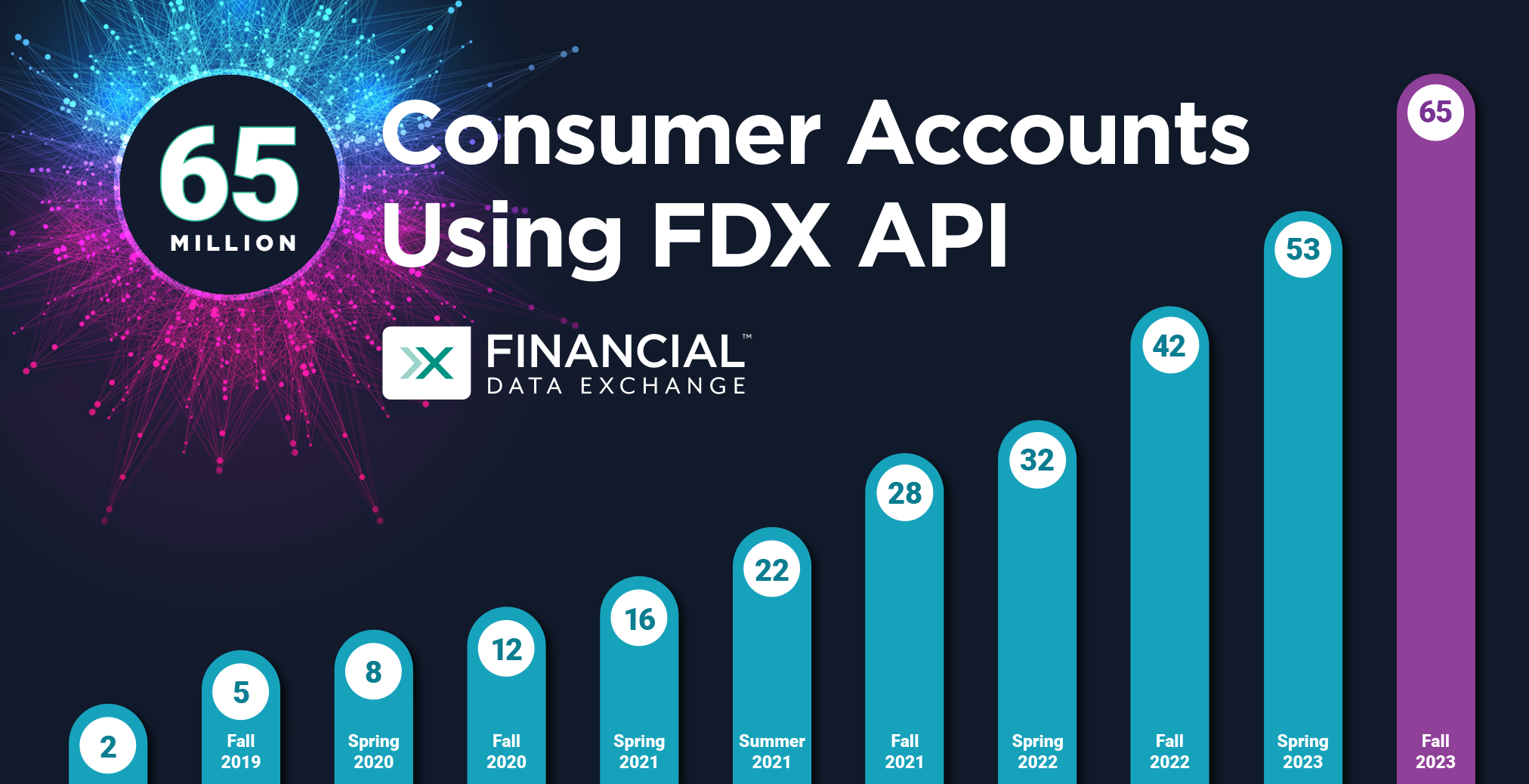

RESTON, Va., October 5, 2023 – The Financial Data Exchange (FDX) today reports that 65 million consumer accounts are now actively utilizing its FDX API for secure open finance data sharing. Since FDX’s last report in April of 2023, a staggering 13 million additional consumer accounts were transitioned to the FDX API. This incredible milestone reflects the widespread trust and acceptance of a standardized approach to accessing financial data and FDX anticipates the growth to continue.

Commenting on this achievement, FDX’s Managing Director, Don Cardinal stated “This is a testament to the hard work of our members and their commitment to a common, free, interoperable standard for the secure, permissioned sharing of financial data via the FDX API.”

Today’s announcement stems from FDX’s Fall 2023 FDX Adoption Metrics Survey, which compiles reporting from the 200+ members of FDX. While the FDX API remains free to view and use, it is essential to note that this survey does not include non-FDX member data.

FDX’s Senior Director of Product, Jean-Paul LaClair, added “Witnessing the rapid growth to 65 million consumer accounts is a clear indication of the financial industry's shift towards a more consumer-centric, transparent approach. Our trajectory with the FDX API affirms the collective vision of a safer, unified financial ecosystem.”

FDX’s anticipated product release will be issued in December to include version 6.0 of the FDX API. The FDX API currently defines approximately 660 unique financial data elements, revolutionizing how individuals and businesses securely access and manage their financial information while fostering innovation and competition within the financial ecosystem.

FDX’s commitment to interoperability has fostered collaboration among more than 200 financial industry members and stakeholders. All FDX members are given the opportunity to participate in the development, growth, and industry adoption of the FDX API and other objectives through FDX working groups and task forces. Operating primarily in the US and Canada, FDX’s Board of Directors includes Bank of America, Citi, Capital One, Envestnet | Yodlee, Experian, Fannie Mae, Fidelity, Finicity, FS-ISAC, Intuit, JPMorgan Chase, MX, Plaid, PNC, Rocket Mortgage, Equifax Canada, Schwab, SIFMA, TD Bank, The Clearing House, Truist, USAA, US Bank, Wells Fargo, Xero, National Bank of Canada, and a rotating observer-level seat for consumer advocacy groups.

About FDX

Financial Data Exchange, LLC (FDX) is a non-profit organization operating in the US and Canada that is dedicated to unifying the financial industry around a common, interoperable, royalty-free standard for secure and convenient consumer and business access to their financial data. FDX empowers users through its commitment to the development, growth, and industry-wide adoption of the FDX API, according to the principles of control, access, transparency, traceability, and security. Membership is open to financial institutions, fintech companies, financial data aggregators, consumer advocacy groups, payment networks and other industry stakeholders. FDX is an independent subsidiary of FS-ISAC. For more information and to join, visit www.financialdataexchange.org.